Austin Housing Market Forecast 2025: Why the Slowdown Could Last into 2026

Published | Posted by Dan Price

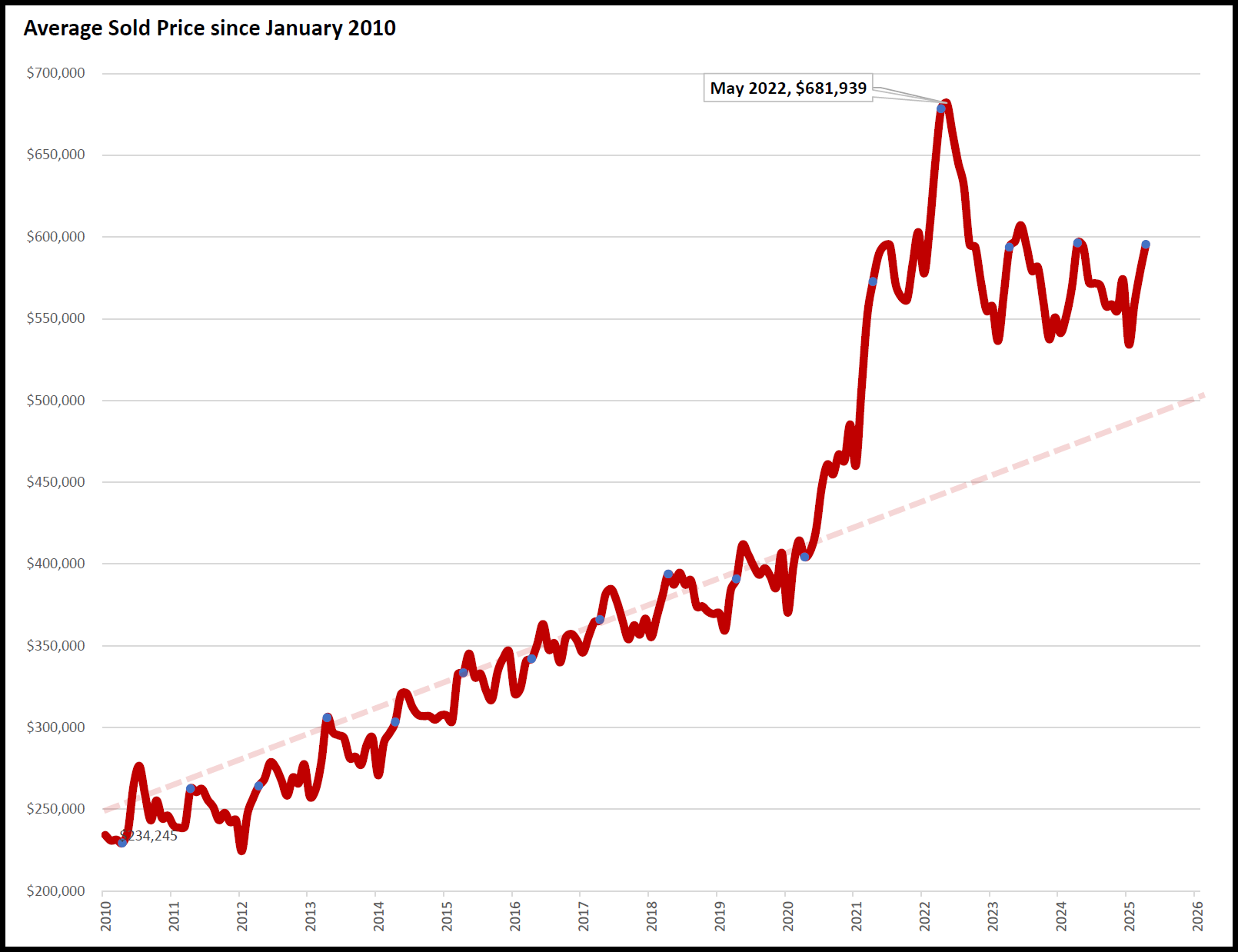

Austin Housing Market Forecast: Slowing Momentum Signals Longer Correction Ahead

As we step into May 2025, the Austin housing market is showing clear signs of continued correction. While some buyers and sellers may be looking for a turning point, the data tells a different story—one of softening demand, rising inventory, and decreasing affordability. Based on the latest statistics, including sales activity, listing volumes, affordability, and key leading indicators like the New Listing to Pending Ratio and the Activity Index, it appears the market will remain under pressure for the next 18 to 24 months.

Let’s begin with inventory. As of May 1, 2025, active residential listings reached 15,796. That’s a 21% increase compared to the same time last year, and one of the highest inventory counts ever recorded in the Austin-area MLS. The number of homes on the market has been climbing steadily every week, adding more than 1,800 listings in just over a month. This surge is pushing Months of Inventory to 5.65—well above the neutral threshold of 4.0 and inching toward a buyer's market. At the same time, pending listings are slightly down year-over-year, signaling fewer contracts are being executed despite more homes being available

One of the clearest signals of a slowing market is the New Listing to Pending Ratio. This ratio measures how many new listings are coming to market compared to how many are going under contract. A healthy market typically has a ratio near 1.0—one pending sale for every new listing. But for the final week of April 2025, that ratio dropped to just 0.53. That means for every two new listings, barely one is going pending. It’s a stark sign that demand is cooling rapidly, and listings are accumulating on the market.

The Activity Index, another leading indicator, is also showing weakness. Sitting at just 23.9%, it reflects a noticeable decline in the rate at which homes are going under contract relative to total listings. That number had been hovering in the 30s earlier this year, but recent data shows a consistent slowdown. Combined with the drop in pending listings and the surge in active inventory, it points to a clear trend: more homes, fewer buyers, and longer selling timelines.

Affordability remains a major headwind. Back in 2020, the average monthly mortgage payment for a median-priced home with 20% down was about $2,000. Today, that number has jumped to over $3,400 in April 2025, despite a relatively flat median price of $450,000. This increase is driven largely by higher interest rates, which remain near 6.8%, and has made homeownership much more expensive—even though prices themselves are not rising dramatically. The result is that many buyers are either priced out or staying on the sidelines, waiting for either rates or prices to come down.

Sales activity further confirms the slowdown. April 2025 recorded just 2,187 closed transactions across the Austin area—a 15.6% drop from March and a 27.1% drop compared to April 2024. This kind of volume contraction, even during what’s typically the busiest part of the year, reinforces the view that the market has cooled substantially.

So what’s the forecast for the remainder of 2025 and into 2026? Based on the combination of weak buyer activity, a cold New Listing to Pending Ratio, record-high active listings, and declining affordability, we anticipate that the Austin housing market will continue to correct gradually over the next 18 to 24 months. Prices may continue to soften slightly, but perhaps more importantly, time on market will likely increase, inventory will build further, and sellers will need to remain flexible on pricing and concessions.

This is not a crash—it’s a normalization after years of extreme appreciation. But for those watching the numbers closely, it’s clear: the recovery will take time. Buyers have more leverage. Sellers need sharper pricing strategies. And everyone—agents, investors, and homeowners alike—should prepare for a slower-moving, more competitive market in the near future.

Request Info

Have a question about this article or want to learn more?